Concept of Economic Development

Economic development is the increase in economic growth and the distribution of the goods and services among the people. It also refers to an increase in production and quality.

Meaning of Development

Explain the meaning of development

Development is a process to improve the lives of people in a country. This involves not only raising living standards, for instance goods and services, but a promotion of self-esteem, dignity, respect and people’s freedom to choose and to take control of their own lives.

Types and Levels of Development

Identify types and levels of development

There are two levels of development, namely individual and national development.Individual or personal level refers to the increase of material well-being of a person like a good house, car and clothes. Also greater freedom of expression, worship, increased human skills and the ability to produce goods and services in a larger quantity.This aspect also includes the educational level of a person.

National or community level refers to the improvement in social, economic, cultural and political affairs of a community or country. It involves the provision of better health services and water accessibility. Political development at the national level involves aspects of good governance, rule of law and human rights.

Types of development

There are two categories of development, namely economic developmentand social development. It is very important to discuss the concept of economic development in modern times because there is no country that can increase the welfare of her people without economic development. Within a country, there is a gap in the living standards of the people. There are people who live a luxurious life while others face hunger. Similarly, mostcountries in the world today are poor; only one third of the countries are rich. The poor countries have to raise the standards of living of their people. These countries must be developed economically.

There is another concept in development, which is economic growth. Economic growth is an increase in the productive potential in an economy. In other words, it is the quantitative increase in goods and services produced in a country in a specified period of time. Economic growth increases the Gross Domestic Product (GDP). The GDP is the actual economic growth.

Meaning of Economic Development

Explain the meaning of economic development

Economic growth is the rate of expansion of national income or total volume of production of goods and services of a country. Many developing countries have somehow achieved reasonable economic growth but there is less economic development. In Tanzania for instance, there is a rise in economic growth every year, yet the lives of majority of the people are not improved. In this situation you will find an increase in the GDP, but the living conditions of the people continue to deteriorate.

Indicators of Economic Development

Identify indicators of economic development

Indicators of economic development are also known as measurements or criteria for testing the degree of economic development of a country. The most frequently used indicators are per capita income of a country, birth rates, population growth, life expectancy, literacy rates and energy consumption. Others are rural-urban migration, unemployment and poverty.

Indicators of Economic Development in Relation to Tanzania

Appraise the indicators of economic development in relation to Tanzania

Activity 1

Find the per capita income of the people if the GNP is Tsh.56 208.4 billion and the total population is 40.7 million.

Per Capita Income

Per capita income of a country is the average income of the people of a given country in a particular year. It is calculated by dividing the total annual income of the country by the population of that country. The total annual income of a country is also referred to as the Gross National Product (GNP) or the Gross Domestic Product (GDP). It is always given in monetary terms.

- Per capita Income= Gross National Product (Total Annual Income of the Country)/Total Population of the country

- Per capita Income = GNP/Total Population of the country

- per capita =28 212.6/ 40.7

- per capita income =Tsh. 693 185

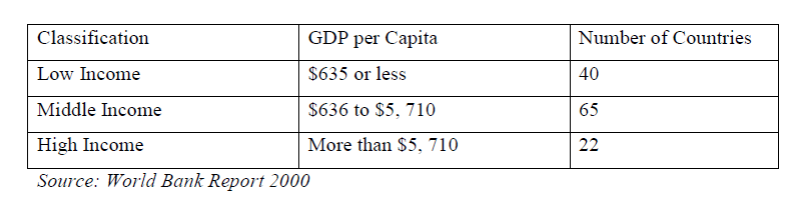

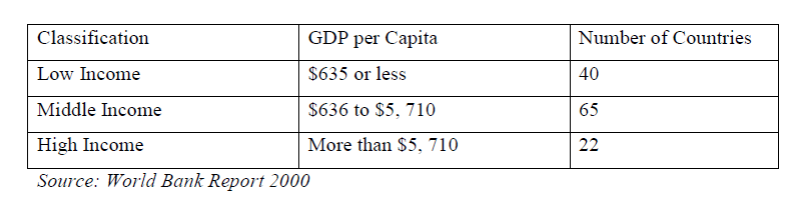

This indicator is considered to be the best single indicator of economic well-being. The International Bank for Reconstruction and Development (IBRD), more commonly known as the World Bank, classifies countries into three groups according to their Gross Domestic Product (GDP) per capita.

Birth rates

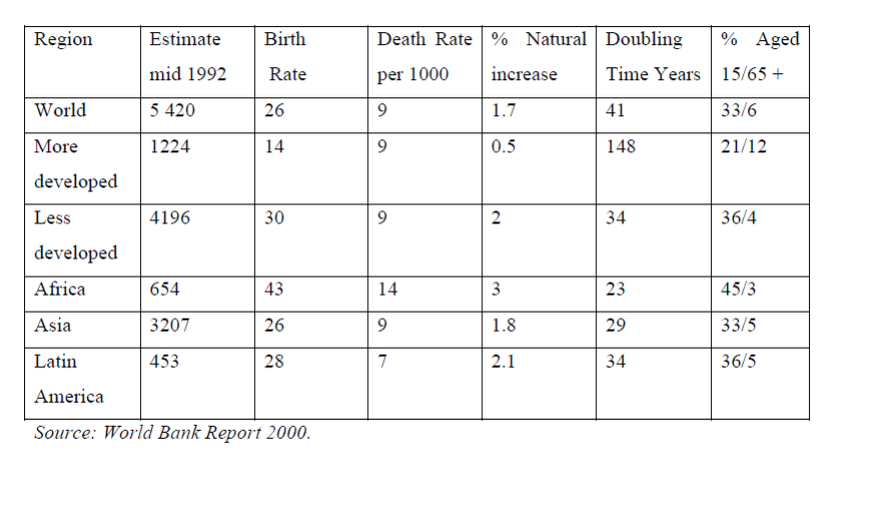

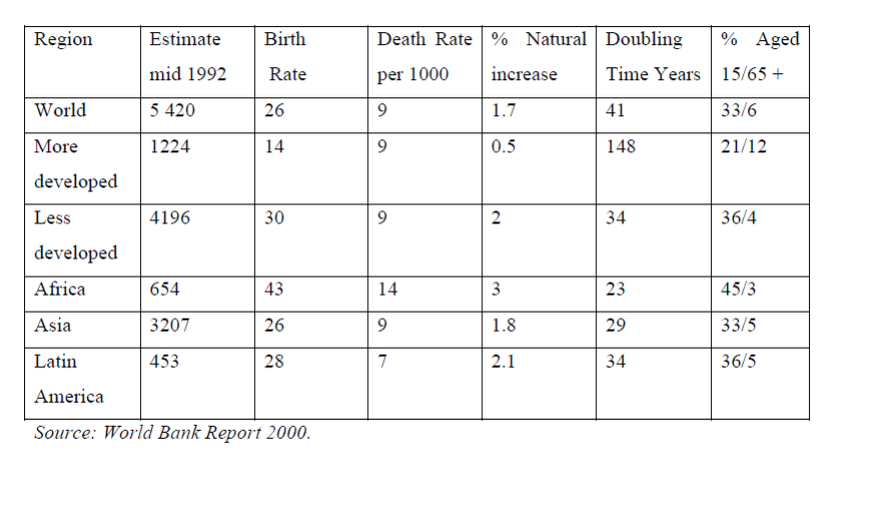

Birth rate is the ratio of total live births to a total live births to total population in a specified community or area over a specified period of time. The birth rate is often expressed as the number of live births per thousand of the population per year. This is the easiest way of distinguishing developing countries from developed countries. The birth rate in low-income countries as a group is 30 per thousand, twice that of developed countries at 14 per thousand.

Population growth

This is an increase of population. In developing countries, the population growth is higher compared to the developed countries. Over the last 50 years, world population has grown very rapidly compared to any previous time. World population growth needs to be studied in order to understand its impact on the process of development.

The reason of population growth in developing countries is the high birth rate. Birth rates remain high even though death rates have fallen. This is because a larger proportion of girls get married at a tender age. They have children, and they have more years in which to have children.

Many governments in the world, including Tanzania's, have established policies aimed at slowing the growth of population. For instance, in Tanzania there is a birth control programme known as “Nyota ya Kijani”. The aim is to ensure fewer children per family, so that poverty can be reduced. In this regard, the government will be able to provide adequate social services to the people.

Life expectancy

This is the average number of years newborn babies can be expected to live if health conditions stay the same. Life expectancy is lower in developing countries compared to indeveloped countries. In developed countries, the deaths of children under the age of five accounts for 1.3% of all deaths, while in developing countries the figure is 10.5%.

The most commonly used indicators of life expectancy are:

- Person/Populationper hospital bed. Medical care is very scarce in poor countries and that is why the death rates arehigh in these countries. The governments have to improve the quality of available health care and the number of people per doctor and hospital beds. In Tanzania, there is a shortage of doctors and hospital beds. There are cases where three patients share a single bed.

- Calories deficiency is a cause of malnutrition. Our bodies do not have sufficient food to provide energy and to maintain good health.

- Protein per day. Types of food and the quantity are important in the maintenance of good health. Lack of protein will cause malnutrition. Malnutrition affects future productivity of a population – the ability to work effectively.

- Population per physician. In developing countries, physicians attend more patients than in developed countries. This is because there are fewer physicians in developing countries.

- The infant mortality rate. This is the number of live-born babies who do not survive to their first birthday out of each thousand babies born in total. The reasons for premature death include poor quality of drinking water and sanitation. Also, inadequate nutrition for pregnant women and infants. Another reason is poor health care provision. Many people fall victim to polio, measles, diphtheria, tetanus, tuberculosis, whooping cough, flu, diarrhea, pneumonia, typhoid, cholera and malaria.

Literacy rates

Literacy is the ability to read and write. Literacy has strong connections with education, openness to change and labour productivity. Literacy is an objective of development.

Energy consumption

The consumption of energy in a country is highly correlated to the degree of industrialization. The poorest countries use very little energy, while the richest industrial countries use a lot of energy. The most common energy used by poor nations like Tanzania is firewood. Industrialized countries use gas, solar energy, and hydroelectric power and coal because they need more energy for their industries. Energy consumption indicates the level of development of a country.

Rural –urban migration

People in developing countries tend to migrate from rural to urban areas. Cities in these countries grow rapidly. The purpose of migration is to get employment. Most of these migrants remain unemployed and are subjected to poverty.

Unemployment

This is a situation whereby able and mentally fit people in a country arejobless and/or do not have formaljobs. There is a high rate of unemployment in developing countriesand itis a serious matter in our societies, particularly among the youth in urban areas. The high level of unemployment may result in civil unrest, fall of standards of living, increased crime like drug abuse, robbery, prostitution, theft and loitering. The other effects are child labour to subsidize family income, separation of families and increased number of street children.

Poverty

Poverty refers to thestate of being poor. Poor people are those who fail to enjoy better living conditions in the society they live in; they are unable to meet the basic needs of life, which are food, clothes and shelter. Poverty is the most distinguishing feature between developing countries and developed ones. In this standard, two in five people living in developing countries are absolutely poor. This type of poverty has been eradicated in developed countries. Poverty is a hindrance to economic development.

Apprising the indicators of economic development in relation to Tanzania.

Tanzania is gradually developing due to implementation of modern technology in many production activities like industries and small scale businesses. We are observing many businessmen and women in many places. The government has established Export Processing Zones (EPZ). The act to establish EPZ was enacted in April 2002 and became effective in March 2003. The main objectives of EPZ are to attract and promote investment for export, increase foreign exchanging earnings and increase employment opportunities. These aimed at attracting and encouraging the transfer of technology and promoting the processing of local raw materials for export.

Currently, eight companies have been licensed as EPZ developers (two in industrial parks, six in single factory units), ten licensed as EPZ operators, five in textiles/ garments, one in mineral processing/jewellery, one in fruit processing, three in reconditioning mechanical, electrical and electronic devices.

Main sectors for EPZ investment are textiles, agro-processing, leather processing and manufacture of leather products. Others are fish processing, lapidary (gold, diamond and gemstones, including the famous Tanzanite), wood products, electrical appliances, and information and communication technology (ICT). This will solve the problem of unemployment, raise the GDP of our country and reduce the rate of poverty.

In Tanzania, agriculture is the backbone of our economy. With the introduction of the policy “Kilimo Kwanza”, the number of people involved in this sector will increase. New labour force involved in farming will be utilized accordingly; this will solve the problems of malnutrition and increase life expectancy.

Activity 2

By using the indicators of economic development, assess the economic development of your community (village/street). Present your findings in the class.

Factors for Economic Development

Identify factors for economic development

Economic development is the change or increase in the economic growth and the distribution of the increased goods and services among the population. For production to increase there must be land, labour, capital, infrastructure, entrepreneurship, technology, education and good governance.

- Land; Land is anatural resource which includes the surface of the earth, lakes, rivers and forests. It also includes mineral deposits below the earth. Land provides space where production can take place. Industries that depend on land include all extractive occupations such as farming, mining, quarrying and fishing. All these economic activities contribute a lot tothe national income. Land is a valuable factor. The value of land depends on location and fertility. The value of land may depend on what one is going to use it for. For instance, land in Tanzania is valuable to agriculturists and those who want to invest in estates, while in United Arabs Emirates land may have no value to an agriculturist but it is valuable to an industrialist who needs oil for industries.

- Labour; Labour refers tohuman resource, the basic determinant of which is the nation's population. It is any mental (intellectual) or physical efforts of human beings made for any material benefit. Labour is the primary factor of production. It is labour that organizes the other factors of production. Labour is an important factor of production because it utilizes other natural resources that are available in production. Without labour, land and capital, nothing can be produced. It supervises the production of commodities. It applies technical know how in the production process.

- Capital; Capital means all man-made productive assets. Capital is used to helot produce other materials. Examples of capital are tools, machines and buildings. Capital increases the productivity of land and labour. Money is used to purchase goods for further production.Capital may be classified into fixed and working capital. Fixed capitals include things like farms, machinery, tractors, and factories. Working capital is used in a single act of consumption, for instance raw materials, goods – in – process and fuel. Capital is important in production because it enables investment. Investments include the building of factories, power stations and the making of tools and implements. If more investments are established, production will increase. Thus, economic development will increase.

- Infrastructure; Infrastructure is the whole web of facilities which need to be in place for productive industry to flourish. Infrastructure includes roads, railways, gas, schools, electricity, telephones, water, sewerage systems and others. Infrastructure is important foreconomic development. The goods produced have to be transported from the production place to the marketing area. If supply will be low then sales will not be good. Telephones are important to reduce movement of labour during the marketing process. Roads must be passable throughout the year. Poor infrastructure leads to poor development.

- Entrepreneurship Land;labour and capital need to be organized in order to produce. The person who organizes the business is known as an entrepreneur. An entrepreneur is a person who is responsible for the profit and loss of the business. He/she is the risk taker. An entrepreneur is important in economic development because he or she provides the funds necessary to bring together the other factors of production. The entrepreneur has to employ labour, buy or rent land and arrange capital. He or she bears the risk of the business. Entrepreneurs make some important decisions regarding the business like what to produce, where to locate the enterprise, and decide on the type of the business organization which may be a partnership or a corporation.

- Technology; Technology is the way people use resources to meet their needs and wants. This includes tools, machines, materials, techniques and the process used to produce goods and services to satisfy their needs. Technology is composed of hardware, software and technical know –how. Hardware is the physical structure and logical layout of equipment or machinery that is used to carry out the required needs. Software is the knowledge of how to use the hardware in order to carry out the required needs. Technical know-how is the learned or acquired skills.The level of output of a firm depends on the quality and quantity of inputs in the existing state of technology. When technology is high, production increases. The level of production in Tanzania is low due to poor technology. For instance in agriculture, despite having fertile and vast land, we cannot produce enough food to satisfy our needs and get surplus for export because of the poor technology we are using in production.In the mining sector, foreign investors have been invited to extract our wealth because we do not have appropriate technology.The availability of technology affects the rate of growth. It increases the productivity of capital and labour and the creation of new products. Lack of or technology causes poor production of goods and services and underdeveloped.

- Education; Education is a vital aspect in production. The quality of labour is a major source of potential growth. Efficiency of labour depends very much on education and training.A worker must have basic skills of reading and writing. They are important to the functioning and productivity of an economy. Developing countries have made a huge effort to provide university Primary Education for all children.Education is very important in the production process, because it reduces the expenditure on the foreign labour. It improves the efficiency of human labour. In Tanzania, the education system trains job seekers rather than job creators. This has led to massive unemployment among the educated people in the country. One of the reasons is that there is low rate of industrial expansion and agricultural modernization.

- Good governance; Governance refers to the exercise of power of the state in managing the country's social and economic resources. It also relates to accountability, rule of law, transparency and citizen participation. The government is responsible to see that there is peace in the country so that people perform their duties harmoniously. If there is no political stability in the country, the level of production will decrease.The government plays a vital role in economic development. It has to provide a conducive environment to the citizens to engage in production. The government establishes policies that will favour people to invest. The government should encourage people to participate in economic activities by supporting them financially.The government must enact good policies which will favour the workers in terms of good salaries and a favourable working environment. It should also create favourable conditions for the functioning of markets, operation of private firms, employment of civil society and community-based organizations in the country.

Activity 3

Referring to features of good governance and its significance, discuss how good governance is practiced in Tanzania.

Importance of Each Factor of Economic Development

Illustrate the importance of each factor of economic development

The importance of each factor of economic development

- Land; Land provides space where production can take place. Industries that depend on land include all extractive occupations such as farming, mining, quarrying and fishing. For instance, land in Tanzania is valuable to agriculturists and those who want to invest in estates, while in United Arabs Emirates land may have no value to an agriculturist but it is valuable to an industrialist who needs oil for industries.

- Labour; Labour is the primary factor of production. It is labour that organizes the other factors of production. Labour is an important factor of production because it utilizes other natural resources that are available in production. Without labour, land and capital, nothing can be produced. It supervises the production of commodities. It applies technical know how in the production process.

- Capital; Money is used to purchase goods for further production.Capital may be classified into fixed and working capital. Fixed capitals include things like farms, machinery, tractors, and factories. Working capital is used in a single act of consumption, for instance raw materials, goods – in – process and fuel.Capital is important in production because it enables investments. Investments include the building of factories, power stations and the making of tools and implements. If more investments are established, production will increase. Thus, economic development will increase.

- Infrastructure; The goods produced have to be transported from the production place to the marketing area. If supply will be low then sales will not be good. Telephones are important to reduce movement of labour during the marketing process. Roads must be passable throughout the year. Poor infrastructure leads to poor development.

- Entrepreneurship, Land, An entrepreneur is important in economic development because he or she provides the funds necessary to bring together the other factors of production. The entrepreneur has to employ labour, buy or rent land and arrange capital. He or she bears the risk of the business. Entrepreneurs make some important decisions regarding the business like what to produce, where to locate the enterprise, and decide on the type of the business organization which may be a partnership or a corporation.

- Technology; When technology is high, production increases. The level of production in Tanzania is low due to poor technology. For instance in agriculture, despite having fertile and vast land, we cannot produce enough food to satisfy our needs and get surplus for export because of the poor technology we are using in production. In the mining sector, foreign investors have been invited to extract our wealth because we do not have appropriate technology.The availability of technology affects the rate of growth. It increases the productivity of capital and labour and the creation of new products. Lack of or technology causes poor production of goods and services and underdeveloped.

- Education; .A worker must have basic skills of reading and writing. They are important to the functioning and productivity of an economy. Developing countries have made a huge effort to provide university Primary Education for all children.\

- Education is very important in the production process, because it reduces the expenditure on the foreign labour. It improves the efficiency of human labour. In Tanzania, the education system trains job seekers rather than job creators.

- Good governance; If there is no political stability in the country, the level of production will decrease. The government plays a vital role in economic development. It has to provide a conducive environment to the citizens to engage in production. The government establishes policies that will favour people to invest. The government should encourage people to participate in economic activities by supporting them financially.

The Role of Financial Institutions in Economic Development

Financial institutions are organizations which deal with financial services, advice, assistance or support to individuals, companies and the public at large. They are established by the public and registered by the authorities. Financial institutions may be private or the publically owned. The types of financial institutions found in Tanzania are banks, insurance companies, and social security institutions. Others are loan-giving institutions and, savings and credit cooperative societies (SACCOS).

- Banks; A bank is an organization that provides financial services like storingand lending money to people or institutions. In Tanzania, there are two main types of banks, namely Central Bank and Commercial Banks.

- Central bank; The Central Bank of Tanzania (BoT) was established following the decision to dissolve the East African Currency Board (EACB) and the establishment of separate central banks in Tanzania, Kenya, and Uganda. In December 1965, the National Assembly passed the bill of the establishment of the Bank of Tanzania. The Bank was opened by the first President of Tanzania, the Late Mwalimu Julius K. Nyerere, on 14th June, 1966.

- The central bank is a national financial heart. The bank is independent from direct government influence when carrying out desirable monetary policies aimed at stimulating economic activities in the economy. The Central Bank of Tanzania carries out its responsibilities in close cooperation with the government, and in particular the Treasury which is primarily concerned with the financial policies of the government. The head is BoT is the Governor, who is appointed by the Presidents of the United Republic of Tanzania.

The Role of Different Financial Institutions in Economic Development

Analyse the role of different financial institutions in economic development

The Bank of Tanzania has important subsidiary central banking functions. The bank has the sole right to issue notes and coins in Tanzania for the purpose of directly influencing the amount of currency in circulation outside banks, thereby providing the economy with sufficient but if possible non- inflationary liquidity.

The functions of the Central Bank of Tanzania in economic development

The central bank is a bankers’ bank. This function includes the acceptance of deposits to act as prudential reserves for these banks (that is the minimum reserves), the willingness to discount commercial and government paper, and the commitment to act as lender of last resort to these banks. It also involves the provision of central clearance facilities for inter-bank transactions.

The central bank is the banker and the fiscal agent ofthe government, and may be the depository of the government. It makes temporary advances to the government through its overdraft facility, subject to repayment within 180 days and through purchases (direct or re-discounting) of treasury bills issued by the government, which mature not later than 12 months from the date of issue. The total amount outstanding at any time of advances made in this manner shall not exceed one eighth the average budgeted revenues of government (average of the actual collected revenues of the previous three fiscal years, excluding loans, grants, other forms of economic aid, and all borrowing, whether short-or long-term).

The central bank may advise the government on any matter relating to its functions, powers, and duties. It may also be requested to advise the government on any matter related to the credit conditions in Tanzania or any proposal, measures, and transactions relating thereto.

The central bank is the depository of the official external assets of Tanzania, including gold and foreign currency reserves. Guarding international reserves may imply the determination of buying and selling rates of gold and foreign exchange in foreign exchange markets and /or the buying and selling of reserve assets for the purpose of sustaining the national currency’s external value. It also includes reserve management, with a view to the prudential investment of the funds, with due regard to safety, liquidity and profitability and external debt management.

The central bank is the supervisor of banks and financial institutions. In general, this activity involves ensuring that commercial banks and other financial institutions conduct their business on and a sound prudential basis and according to the various laws and regulations in force. It includes the supervision of banking conduct and the licensing of financial institutions. According to the banking and Financial Institutions Act of 1991, and the new BoT Act, the main responsibilities of the Bank of Tanzania are:

- Implementation of prudential controls concerning capital adequacy, liquidity, concentration of credit and risk diversification, asset classification and provisioning, and prohibited activities.

- Licensing of banks and financial institutions.

- Facilitation and monitoring of Deposit Insurance Fund, the purpose of which is the protection of small depositors.

- Modification and monitoring of the minimum reserve requirements and foreign exchange exposure.

The central bank promotes financial development. This refers to the establishment of an effective financial system, with the aid of which financial transactions minimum amount of cost and time involved. In this connection, the central bank has to be a facilitator of advanced clearing and transfer systems. It also implies that the necessary banking services, as for example deposit facilities and loan facilities, are made available. Included here is also the availability of certain specialized institutions, which could be represented, for example, by an industrial development bank and/or an agricultural development bank and micro-finance institutions, and the facilitation of a money market, a capital market, and a foreign exchange market.

Commercial banks

Commercial banks are established for the purpose of earning profit through accepting savings, and utilizing these savings of their customers to extend loans and advance on which they charge interest. These banks attract the public to deposit by giving interest rate on those deposits once made with them. All the commercial banks are controlled by the Central Bank of Tanzania (BoT).

Some of the commercial banks operating in Tanzania are National Bank of Commerce (NBC), National Microfinance Bank (NMB), Tanzania Investment Bank (TIB), Akiba Commercial Bank (ACB), Standard Chartered Bank (SCB), Stanbic Bank (SB), Habib African Bank (HAB), Diamond Trust Bank (DTB), Exim Bank (EB) and Cooperative Rural Development Bank (CRDB).

The functions of commercial banks in economic development

The following are some of the functions of commercial banks in economic development:

- Advise their customers on issues concerning investment, trade and how to run them.

- Act as trustees, and can also keep valuable documents like wills, certificates and gold. Hence they ensure safe custody.

- Provide foreign exchange to customers and help their customers in carrying out foreign trade.

- Offer the facility of standing order where they make regular payment to a customer’s creditor on behalf of insurance premium and electricity bills.

- Facilitate withdrawal of money on current accounts any time by the use of a cheque.

- Offer bank draft facility to different persons in the economy, especially the traders.

- Extend loans to several individuals and companies that are engaged in agriculture, ranching, mining, industry and trade. In so doing, the economy of a country grows.

- Facilitate deposits of money. The commercial banks pay interest rates on the deposits.

Condition and Procedures for Getting Services from Each Financial Institution

Point out the condition and procedures for getting services from each Financial Institution

There are common conditions and procedures for getting services from the commercial banks. Any person maybe a member of any bank he or she wants to join. A person has to take an introductory letter from his or her employer or from the local government officials where he or she lives. He or she will present the letter to the authority concerned in the bank. A special form will be given for filling in his or her particulars and the type of account he or she prefers. The applicant must provide the name of a referee. When the bank has approved the application it will open an account for its new customer. The customer will be given an account number. There are various types of accounts such as savings account, current account and fixed deposit account.

The customer may take a loan as per bank regulations. The purpose of a bank loan is to provide the borrower with a lump sum of money to facilitate various undertakings. To get a loan a person will make a formal application to the bank. He or she might be interviewed by the manager. The manager has the authority of deciding whom it is safe to lend to. When asking for the loan from the bank, the bank may ask for collateral security. It is something given by the customer to guarantee the payment of the loan, the customer would be required to repay the loan by regular installments over an agreed period of twelve, eighteen, twenty-four or thirty six months.

The Strengths and Weaknesses of Each of the Financial Institutions

Assess the strengths and weaknesses of each of the financial institutions

Strengths of commercial banks

Commercial banks have the following strengths in their contributions over the economic development of the country. They provide

- Easy access of services from the automated Teller Machines (ATM). This makes it easier for customers to access the bank services all the time.

- Security to their customers.

- Investment advice, management of investments, buying and selling of investments.

- Safe custody of valuables (night safes).

- Cash dispensers.

- Loans to their customers who want to run businesses, build houses, and buy cars, for improving their living standards.

Weaknesses of commercial banks

Apart from those mentioned strengths of commercial banks, there are some weaknesses too, including:

- Loans repayment interest rate is high. Many people are discouraged fro taking loans because of high interest rate. For instance, some banks chargeup to 36% interst rate.

- Bureaucracy in taking loans from the banks. The filling in the application form and the maturity of the loan takes a lot of time.

- Referees and collateral security is a hindrance to many customers. Due to this requirement, not everybody can get loans.

- Low accountinterest rates.Owners of the accounts in the banks are paid little interest annually. This discourages people to deposit their money in commercial banks.

Activity 4

“The central Bank of Tanzania is the mother bank of the banks in the country”. Discuss.

Savings and Credit Cooperative Societies (SACCOS)

These are organized groups in which members contribute capital through savings. The money collected from members is used to open various ventures and profits obtained used to pay interest to the saver. Members can borrow money and return it with an interest within the agreed time. This might be six, twelve, eighteen or twenty-four months.

In Tanzania, SACCOS are developing and becoming very popular. Different people including workers have established SACCOS for the purpose of raising their living standards and eradicating poverty. Membership of the SACCOS is voluntary. The members know each other and conduct meetings regularly. In fact, it is family of its kind.

Principles of SACCOS

SACCOS members are bound with the following principles:

- All members get fixed interest on their capital contributed.

- They get dividends according to their contribution annually.

- Members have equal voice each has one share one vote.

- If one wants to withdraw his or her membership from the society, his/her money is refunded after submitting his/her letter of resignation.

- Leaders are elected in a democratic way.

Importance of SACCOS in economic development.

Members can take loans for investment in various economic activities which improve their living standards as well as the national income. They will be an able to satisfy their daily needs such as paying school fees for their children and constructing houses. Members can also borrow money for starting businesses.

Conditions and procedures for getting services from SACCOS

SACCOS provide a number of services to their members, like banking services. Any member who deposits his savings and assets can withdraw them in time of need. SACCOS provide loans to their members. Money given as loans is collected from the members of that SACCOS. SACCOS may take loans from other banks or buy shares from different firms and companies. Through their shares they get dividends, which are usually shared among the members according to their contributions. To get any services from SACCOS one must be a member.

There are forms given to the applicants to fill in how much they want to borrow and how they will refund. The applicant must be sponsored by other members. He or she should list the property which will be confiscated in case he or she fails to pay back the loan. There is a committee which goes through each applicant’s request, examining the behaviour of the member carefully to find out if he or she can reimburse the loan. The committee then concludes whether to give or not to give the loan. Loans are utilized for various purposes such as construction of houses, starting a business, emergencies, paying school fees, livestock keeping and buying fishing implements.

Strengths of SACCOS

SACCOS have the following strengths in their contributions to the economic development of the country.

- They give loans to their members.

- They provide education of entrepreneurship that is how people can start business.

- They create employment opportunities for the members.

- They establish various social and economic ventures such as purchasing land or building a dispensary.

- They provide financial assistance to members who are widows.

Weaknesses of SACCOS

Apart from those mentioned strengths, SACCOS have the following weaknesses:

- There is bureaucracy in processing the loans.

- There is favoritism in the provision of loans; other people are denied loans without genuine reasons.

- There are not enough educated personnel to run SACCOS.

- There are various conflicts in many SACCOS between the members and their leaders.

- Funds are not properly managed by the members.

Many SACCOS are dormant. There are members who take loans and do not pay them back hence causing suffering to those who deposited their money in the society.

Insurance companies

Insurance companies are financial institutions that deal with managing risk of a firm or business, people and their properties. There are mainly three types of insurance, namely life insurance, health insurance and liability insurance.

- Life insurance is a kind of insurance that guarantees a specific sum of money to a designated beneficially upon the death of the insured, or to the insured if he or she lives beyond a certain age.

- Health insurance is an insurance against expenses incurred through illness of the insured.

- Liability insurance insures property such as automobiles and professional/ business mishaps.

In Tanzania there are many insurance companies. Some of them are national Insurance Corporation (T) Ltd, Reliance Insurance Co.Ltd, Zanzibar Insurance Corporation, Jubilee Insurance Co.Ltd, Tajack Insurance Co.Ltd and Prudential Insurance.

Importance of insurance in economic development

The following are some of the importance companies in economic development:

- They restore loss because they take you back to the condition you were in before the disaster.

- They cover disasters that might affect the individual (protection).

- They reduce losses from auto accidents on the roads and fire. In running a business or any production activity mishaps may occur, thus it is advisable to insure against uncertainties that might occur.

Strengths of insurance services in Tanzania

Insurance services have the following strengths in their contributions to the economic development of the country.

- Many clients have been compensated in case of loss of poverty.

- In other types of insurance, for instance life insurance, the insured is paid back his or her contributions with interest at the end of the contract.

Weaknesses of insurance services in Tanzania.

Apart from those mentioned strengths of insurance services, there are some weaknesses too, including:

- Insurance services are not accessible in rural areas.

- There is a need to educate Tanzanians on the importance of insurance services.

- Many insured people complain that insurance companies delay to compensate them in case of a loss.

- The procedure to get compensation takes a long period of time.

- There are unfair methods applied by some of the insurance companies to avoid full and timely compensation for the insured asset.

Social security institutions

Tanzania, like many other countries in the developing world, has strong informal social security and formal social security systems. Informal social security systems are such as Village Community Banks (VICOBA) UPATU, UMASIDA and VIBINDO. These are locally formed by people in their areas or community for the aim of helping each other in socio-economic issues.

The formal social security systems found in Tanzania are the National Social Security Fund (NSSF), Parastatal Pension Fund (PPF), National Health Insurance Fund (NHIF), Local Authorities Provident Fund (LAPF) and Public Service Pension Fund (PSPF).

NSSF offers social security coverage to employees of the private sector and non-pensionable parastatal and government employees. PSPF provides social security protection to employees of the central government under pensionable terms, whilePPFoffers social security coverage to employees of both private and parastatal organizations. LAPF offers social security coverage to employees of local government and the NHIF offers health insurance coverage to pensionable employees of the central government.

The Social Security Regulatory Authority (SSRA)

Social Security Regulatory Authority (SSRA) is a regulatory and supervising body of the functions of all social security schemes in the country. It wascreated under the Social Security Regulatory Authority Act, 2008, which President Jakaya Mrisho Kikwete assented to in June 2010 and which became operational in September 2011. The authority has the role of ensuring the funds are sustainable, project interests, increase coverage and reduce the burden to the government.

Functions of Social Security Regulatory Authority (SSRA)

The following are some of the functions of Social Security regulatory Authority in economic development:

- Register all managers, custodians and social security schemes.

- Regulate and supervise the performance of all mangers, custodians and social security schemes.

- Issue guidelines for the efficient and effective operations of the social security sector.

- Protect and safeguard the interests of members.

- Create a good environment for the promotion and development of the social security sector.

- Advice the minister concerned on all policy and operational matters relating to the social security sector.

- Adopt the conventional broad guidelines applicable to all managers, custodians and social security schemes.

- Monitor and review regularly the performance of the social security sector.

- Initiate studies, recommend, coordinate and implement reforms in the social security sector.

- Appoint an interim administrator of schemes, where necessary.

Strengths of social security institutions

Social security institutions have the following strengths in their contributions over the economic development of the country.

- Provide security to their member’s contributions.

- Doing business by giving loans to firms, associations, and individuals with interest.

- Invest in the construction of houses for accommodations in town and sell some of them to individuals.

- They give benefits to the members when they retire.

- Assist members when in trouble such as sickness or treatment to expectant mothers.

- Refund expenses incurred during the funeral of their member to the family concerned.

Weaknesses of social security institutions

Apart from those mentioned strengths of social security institutions, there are some weaknesses too, including:

- Poor record-keeping as some members sometimes complain that their contributions are not shown on the respective records.

- Delays when giving services to the members. It takes about six months to get benefits when a member retires.

- Education to the members is inadequate because most of them are now well informed about their rights and contributions.

- Some employers do not provide the correct contributions to the concerned social security scheme.

- Some social security institutions are not giving loans to the members especially when a child wants to go to school and other development activities.

- Money value always fluctuates which causes a negative impact to members since it affects their purchasing power.

Loan –giving institutions

There are several financial institutions like banks, finance companies and private money lenders, which provide loans to people. The loan taken will depend on the purpose for which it is to be taken. There are various types of loans which are available like commercial lending, house-building loans, home financing and mortgage financing.

The financial resources of a person help him or her to ascertain whether it is a rational decision to take a loan. The loan should be taken at reasonable interest rates. The person needs to compare the interest rates from multiple lenders. The repayment of loans is dependent on the prevalent interest rates of the market.

The time of the actual repayment of the principal amount should be decided in advance. A favourable adjustable rate protects a person from being in trouble in future. Any lending agency will be interested to know your creditability, if you will be able to pay monthly installments or not.

Strengths of loan institutions.

Loan-giving institutions have the following strengths in their contributions to the economic development of the country.

- People who take loans from these institutions establish petty businesses which raise income to their families.

- Education provided is free of charge to all members. They are trained on how to invest and spend money wisely.

- When members sit together and train, they form unity among themselves. They sit in groups of five, six, seven or ten.

Weaknesses of loan-giving institutions

- Apart from those mentioned strengths of loan-giving institutions, they loans and put their guarantors in trouble.

- The interest imposed on the loan is very high.

- The loans given are small in quantity and cannot finance a large investment.

Activity 5

Debate topic: “Loan-giving institutions are a burden rather than a help to the people.”

The role of Government in Economic Development

The government formulates policies which aim at attaining economic development. The government creates good conditions for all sectors of the economy. For instance, in agriculture, the government provides storage facilities for crops produced in rural areas.

The Role of Government in Economic Development

Explain the role of government in economic development

the farmers on modern methods of production and how to look after their harvests. It also provides subsidized pesticides, fertilizers and equipment such as sprayers, hoes and power tillers in rural areas. The government encourages farmers to join cooperative societies and gives them loans.

The government encourages society to have a culture of saving and investing. The culture and habit of saving and investing generates wealth for individuals, households, communities and the nation, in the same vein, a culture of wealth creation and accumulation for development must also be reinforced by a culture of maintenance to prevent unnecessary loss of capital stock.

The government promotes a broad human development strategy; it encourages the society to upgrade itself and improve its productivity. The government creates an incentive system that encourages and rewards individuals, groups, and firms to embrace initiative, creativity, innovation and excellence. This transformation is reflected in the education system, training institutions, and recruitment and promotion process.

The government provides a good environment for actors to effectively harness domestic resources in order to attain competitiveness in their diverse economic activities. Competence and competitiveness, as driving forces, are realized through sound macroeconomic policies, adequate and reliable infrastructural development, quality education, effective utilization of domestic resources, higher productivity and strengthening of the capacity to effectively anticipate and respond to external changes. The government also has a duty of providing security and favourable environment for investors in the country.

Effectiveness of the Government in Economic Development

Assess the effectiveness of the government in economic development

The government plays an important role in economic development. For instance in the 1980s the government adopted the policy of trade liberalization, which led to the mushrooming of commercial activities in Tanzania. Many local and foreign investors started investing in this sector. Since then, the commercial sector has been expanding tremendously.

Areas where the government has been ineffective in economic development

Apart from the mentioned effectiveness of the government in economic development, there is some ineffectiveness too. Some of this ineffectiveness is:

- Signing weak contracts with investors which do not consider the national interests, for instance mining contracts and privatization of Tanzania railway Cooperation (TRC) to Tanzania Railway Limited (TRL).

- Poor tax collection where the government loses a lot of money due to unnecessary tax exemptions and tax avoidance.

- Failure to control inflation. The increase in inflation is attributed to a combination of exogenous shocks. Some of the exogenous shocks include the hike in global oil and flood prices, the decrease in demand and price of primary exports in the world market. Other shocks include extreme weather conditions, which adversely affect agricultural produce and power supply, and consequently inhibit the growth of other sectors of the economy.

- The poor transport system affects the economic development of Tanzania. For instance, traffic jams in cities is due to poor infrastructure and city planning.

- Inefficiency of power supply. The government has failed to make proper use of the available waterfalls, natural gas, coal and uranium to solve the power problems in the country hence affecting economic production in various sectors like industries.

- Lack of good governance and accountability shows the inefficiency of the government in spearheading economic development. There has been rampant corruption in Africa which hinders economic development.

- Dependence on foreign aid to finance the budget of the nation affects the economic development of the country especially where the aid is not given on time. For instance, the government prefers the General Budget Support (GBS) as one of the sources of external financing modalities. The GBS contributed Tshs.4 billion in 2008/2009 budget.

The Role of the Private Sector in Economic Development

The private sector in an economy is formulated under government policies but owned individual or privately. Although the private sector provides services to the public, it aims at maximizing profits. In a private sector there are two components, namely the formal and the informal sectors.

Components of the Private Sector and Importance of the Formal Sector in Economic Development

Identify components of the private sector

The private sector in an economy is formulated under government policies but owned individual or privately. Although the private sector provides services to the public, it aims at maximizing profits. In a private sector there are two components, namely the formal and the informal sectors.

The formal sector

The formal sector encompasses all jobs with normal hours and regular wages, and is recognized as income sources on which income taxes must be paid. This sector is composed of all those private firms established legally by the registrar of companies. Their businesses are legally performed, opened at an area known publicly. They pay tax and other duties to the government. Examples of businesses undertaken in the formal sector are industries, agriculture, commerce and trade, transport and communication. The owners of these sectors of the economy follow rules and communication. The owners of these sectors of the economy follow rules and regulations established by the government.

Importance of the formal sector in economic development

The formal sector plays a significant role in economic development.

- Provides employment opportunities to skilled, semi-skilled and unskilled labour. People are employed according to their skills in a particular job. Thus, their living standard increases.

- Helps to mobilize aid from foreign countries and international organizations like the International Monetary Fund (IMF) and the World Bank.

- Increases income to the country as owners of the firms pay tax to the government. The tax is utilized by the government in various development projects in the country.

- Brings in foreign exchange, skilled power and capital.

- Encourages competitions because of the existence of the formal sector.

- Creates availability of goods and services which are of good quality due to competition.

- Provides support to the people who have been affected by disasters.

The informal sector

The formal sector has many names; some of them are invisible sector, non-planned activities and unstructured sector. Others are informal economy, people’s economy, one-person enterprise and urban subsistence sector.

The informal sector or economy as defined by governments, scholars or bank is the part of an economy that is not taxed, monitored by any form of government, or included in any Gross National Product (GNP). Examples of people who engage in the informal sector are water sellers, street vendors, buckers and shoe shiners.

In developing countries, around 70% of the potential working population earns its living through the informal sector. They define the sector as that type of sector where people earn a living self-employment and they are not on anyone’s payroll. Most of them live and work in this sector not because it is their wish or choice but because they have no chance of being hired by an employer from the formal sector.

In describing this sector, one should bear in mind that the formal economy is not a deviation of the formal economy. The sector shows the initiative of people who have failed to get formal employment engaging in various economic activities to earn a living.

Characteristics of the informal sector

The formal sector involves economic activities that are not regulated by labour or taxation laws or monitored for inclusion in the Gross Domestic Product (GDP) estimates.

There are two types of the informal sector activities, namely coping strategies (survival activities) and unofficial earning strategies (illegality in business). Coping strategies include causal jobs, temporary jobs, unpaid jobs, and subsistence agriculture.

Importance of the Informal Sector in Economic Development

Illustrate the importance of the informal sector in economic development

Though most of the activities in this sector are performed illegally, they contribute to the economic development of our country. The following is the importance of the informal sector in economic development:

- Provides jobs which reduce the unemployment problem

- Generates income for individuals linked to these activities.

- Helps to alleviate poverty.

- Bolsters entrepreneurial activity.

- Helps to bring commodities to the customer‟s doors. This helps those customers who stay away from the city center.

- Make easier the supply of goods and services since the exchange takes place on the same day.

- Contributes income to the local government.

Problems Facing the Informal Sector

Analyse the problems facing the informal sector

Apart from the mentioned importance of the informal sector in economic development, there are some problems too. Some of those problems are:

- Many jobs are low-paid and the job security is poor.

- There are no proper places set for them to conduct their businesses.

- Lack of transportation means. For instance, “Machinga” guys walk long distances to sell their goods.

- Some of the businesses do not address the issue of hygiene.

- Lack of enough capital which limits the expansion of the businesses.

- Lack of warehouse for traders to keep their stock or commodities.

- Lack of creativity among the members due to low levels of education.

- They are not recognized by the authorities and therefore there is no freedom in doing their businesses.

- No fringe benefits from institutional sources because the activities are not recognized.

- Absence of trade union organization.

Ways of Improving the Informal Sector

Propose ways of improving the informal sector

The informal sector may be improved in several ways. Some of these include the following:-

- The government should recognize the sectors by registering all the owners of these businesses.

- Proper places should be located where people can operate their activities comfortably

- People should be educated on how to conduct their activities properly and the importance of cooperation and unity. If they are united it will be easier for them to get loans from financial institutions.

- Health officers must visit these areas to inspect and educate people on all issues relating to health.

No comments:

Post a Comment